With the advent of PayID, Australian players have gained a convenient way to make payments on online casino sites. It provides the ability to instantly credit money directly from a player’s bank account without requiring the entry of a large amount of financial information. The simple procedure of integrating the service into Australia’s financial systems, combined with its rapid spread, has ensured growing popularity for a service created by Australian banks and specifically designed for Australian users.

PayID is considered one of the fastest and most secure payment methods. This is achieved by using bank-grade security methods, comparable to those used for regular transfers or credit card payments. At the same time, this financial tool is suitable for both casino deposits and withdrawals in Australian dollars, with minimal processing time. Let’s explore the core of the service and its integration with the Australian banking system.

Table of Contents

ToggleHow PayID Works

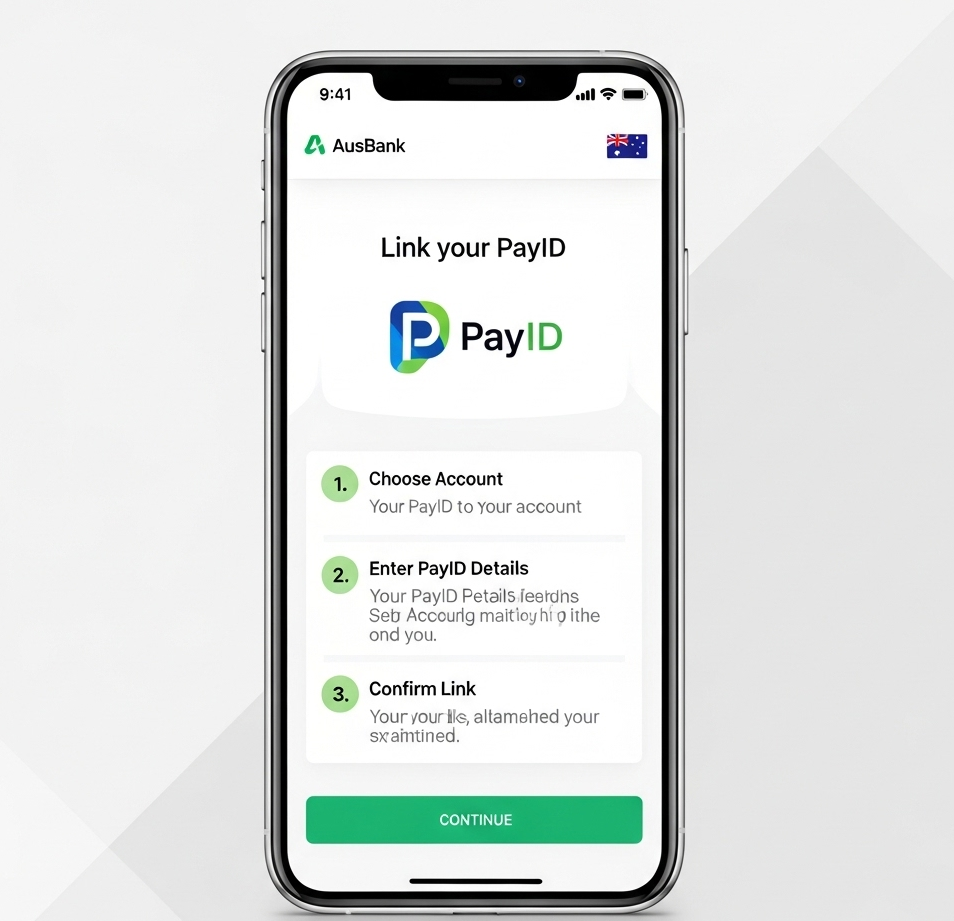

The payment system was created by the New Payments Platform (NPP) to simplify online money transactions. It is designed exclusively for Australians, allowing them to skip entering BSB and personal information, such as the cardholder’s name, expiration date, or CVV code. Its principle is based on using an identifier, such as an email or mobile phone number, for a secure transaction.

This banking technology allows players to forget about the need to remember long account numbers or debit/credit card details. Paying with an identifier enhances user convenience, offering a straightforward payment solution for purchasing goods, services, or playing games with real money.

The payment platform itself was launched as part of a large-scale project to modernize the banking system. Today, most financial companies use PayID for various purposes. The service is excellent for playing in online casinos as it performs the main function: instant crediting of money with a high level of security.

Why Pay ID is Available in Many Online Casinos

Gamblers prefer to have access to secure and instant transfers using a simplified interface. Given the integration of Pay ID with major Australian banking institutions, all transactions are carried out automatically and instantly, without delays or failures. This approach is especially valued when playing live games with live dealers, activating temporary bonuses, or participating in tournaments.

Additionally, the payment gateway helps you save money when using a pokies app pokiemonster.com/pokies-apps. When making casino deposits, you are unlikely to have to pay additional fees. They are also absent when withdrawing winnings. Besides, the risk of errors when processing transfers is minimized, as you do not need to record full account numbers, bank card details, or other sensitive information. A mobile phone number or email address associated with your online banking account is sufficient for payment. After that, it’s an automatic transfer system after full confirmation by the account holder. Therefore, funds will be credited to the online casino balance within a few seconds to 15 minutes.

It is worth noting that the service also facilitates withdrawals of winnings. You need to perform the actions in reverse order by going to your account. Find the Withdrawals or Wallet page, and there select Pay ID. Specify the required amount and confirm the withdrawal, processed within 0-1 hour.

Payment Integration with Australian Banks

Pay ID is not a separate system or wallet, but an interface directly embedded in the online banking or infrastructure of Australian banks. It operates based on the NPP, utilizing the OSKO standardization provided by the service provider BPAY. The service processes online payments in real-time, integrating with banking institutions and credit unions across the Green Continent. Therefore, the speed of payment processing is not affected by working days, weekends, or holidays, ensuring instant receipt of funds 24/7.

More than 100 financial institutions in Australia support PayID, including:

- Commonwealth Bank

- ANZ

- Westpac

- NAB

- ING

- Bendigo Bank

- Bank Australia

Benefits of Integrating Pay ID with Banks

Our experts have analyzed the service’s operation and highlighted its main advantages:

- No need to enter a bank account number or BSB

- Instant transfers without delays or technical glitches

- The convenience of confirming payments in mobile online banking

- 24/7 online transactions without manual payment processing

- The ability to request a transaction cancellation under certain conditions

To fully understand the advantage of this payment method, we recommend looking at the table:

| Parameter | PayID | Classic Bank Transfer |

| Data for input | Mobile number/Email/ABN | BSB + account number |

| Transfer time | Up to 60 seconds | 1–3 business days |

| Availability in banks | 100+ banks | All banks |

| Recipient confirmation | Yes, the name is displayed | No |

| 24/7 operation | Yes | No |

| Adaptability for online casinos | Yes (instant deposits) | Rarely used |

Conclusion from Experts

The integration of this payment method with Australia’s financial system provides residents with a simple and convenient way to make online payments that fit perfectly into the iGaming industry. The innovative payment platform streamlines the user experience, encouraging players to trust their transfers to a banking method that offers maximum security and authentication.

It is important to understand that paying for bets with an identifier is simple, even for beginners. You only need to select a bank, enter an amount, and confirm the payment in the application, just as you would for a regular money transfer. You can use any mobile device or your home PC for this.